How To Create Financial Projections In Excel

Financial Projection Template

Our financial projection template will help you forecast future revenues and expenses by building up from payroll schedules, operating expenses schedules, and sales forecast to the three financial statements.

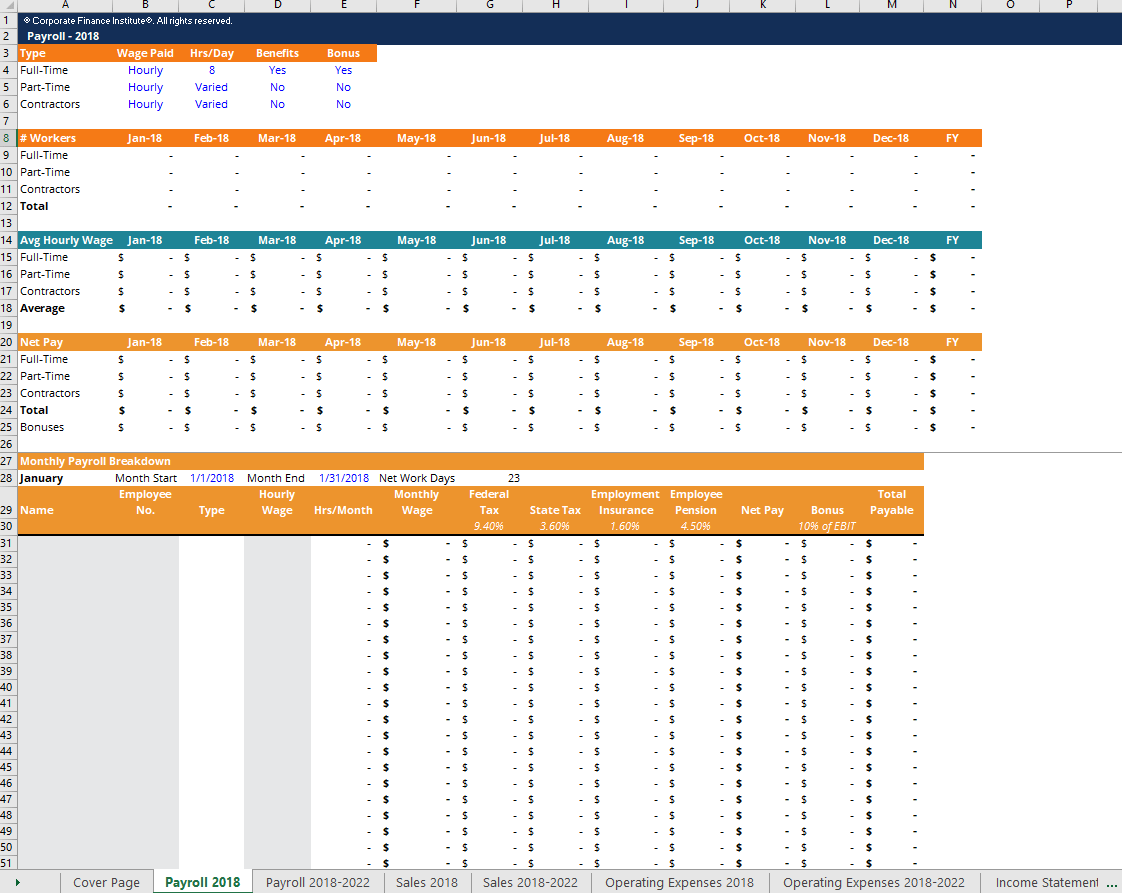

Below is a screenshot of the financial projection template:

Download the Free Template

Enter your name and email in the form below and download the free template now!

Financial Projection Template

Download the free Excel template now to advance your finance knowledge!

Components of a financial projection template

This financial projection template contains the following sections:

#1 Payroll (current year)

In the payroll Payroll Accounting Payroll accounting is essentially the calculation, managing, recording, and analysis of employees' compensation. In addition, payroll (current year) worksheet, you will input the payroll expenses for each of the full-time employees, part-time employees, and contractors. The model helps you break down the salary, taxes, employee insurance, pension, and employee bonus expenses so you can easily track the total amount for each of the items. These individual monthly payrolls then roll up to the summary tables, which automatically calculate the average hourly wage and net pay for each month (all expenses except bonuses) by staff type.

#2 Payroll (forecast)

In the payroll (forecast Forecasting Methods Top Forecasting Methods. In this article, we will explain four types of revenue forecasting methods that financial analysts use to predict future revenues. ) worksheet, you will put your own assumptions for the growth rate of the number of workers for the period of forecast. These are the only manual inputs required for the model. Once the assumptions are filled in, the pre-entered formulas will generate the payroll forecast for the rest of the period and calculate average hourly wages by staff type. You'll also be able to estimate the total amount of taxes, employee insurance, and pension expenses for each of the years.

#3 Sales (current year)

In the sales (current year) worksheet, you'll input the per-unit sales price, the number of units sold, and the per-unit cost of goods sold for each product line under the "sales breakdown" section. The model will automatically calculate the monthly revenue Sales Revenue Sales revenue is the income received by a company from its sales of goods or the provision of services. In accounting, the terms "sales" and , COGS Cost of Goods Sold (COGS) Cost of Goods Sold (COGS) measures the "direct cost" incurred in the production of any goods or services. It includes material cost, direct , and gross margin Gross Margin Ratio The Gross Margin Ratio, also known as the gross profit margin ratio, is a profitability ratio that compares the gross profit of a company to its revenue. for each product line, which are linked to the summary tables at the top of the worksheet. You'll be able to quickly understand the sales and margin for each product for the current year.

#4 Sales (forecast)

In the sales (current year) worksheet, assumptions on sales growth rate are entered for the forecast period to generate the predicted revenue, COGS, and gross margin for the following years.

#5 Operating expenses (current year)

The operating expenses (current year) worksheet is for you to enter the actual operating expenses for the current year. These will help build up the forecast for operating expenses and the income statement.

#6 Operating expenses (forecast)

In the operating expenses (forecast) worksheet, the operating expenses forecast for the next few years will be calculated using the assumptions for each of the expense items.

#7 Income statement (current & forecast)

The income statements Income Statement The Income Statement is one of a company's core financial statements that shows their profit and loss over a period of time. The profit or for the current year and forecast period are built up by linking to values in the sales worksheets and operating expenses worksheets.

#8 Balance sheet (current year)

This balance sheet Balance Sheet The balance sheet is one of the three fundamental financial statements. The financial statements are key to both financial modeling and accounting. worksheet consists of two main sections: balance sheet and supporting schedules. Balance sheet items such as accounts receivable Accounts Receivable Accounts Receivable (AR) represents the credit sales of a business, which have not yet been collected from its customers. Companies allow , inventory Inventory Inventory is a current asset account found on the balance sheet, consisting of all raw materials, work-in-progress, and finished goods that a , accounts payable Accounts Payable Accounts payable is a liability incurred when an organization receives goods or services from its suppliers on credit. Accounts payables are , and retained earnings Retained Earnings The Retained Earnings formula represents all accumulated net income netted by all dividends paid to shareholders. Retained Earnings are part will be manually input, while items such as cash, property and equipment PP&E (Property, Plant and Equipment) PP&E (Property, Plant, and Equipment) is one of the core non-current assets found on the balance sheet. PP&E is impacted by Capex, , and long-term debt will be linked to other parts of this financial projection template. For example, the debt & interest schedule under the supporting schedules section will help you compute the amount of debt closing and interest expenses Interest Expense Interest expense arises out of a company that finances through debt or capital leases. Interest is found in the income statement, but can also , which will then be linked back up to the balance sheet as long-term debt and to the income statement as interest expense.

#9 Balance sheet (forecast)

This balance sheet forecast worksheet is built up by taking the current year balance sheet and calculating the following years' values using assumptions such as accounts receivable days, inventory days Days Sales in Inventory (DSI) Days Sales in Inventory (DSI), sometimes known as inventory days or days in inventory, is a measurement of the average number of days or time , accounts payable days Days Payable Outstanding Days payable outstanding (DPO) refers to the average number of days it takes a company to pay back its accounts payable. Therefore, days , and capital expenditures Capital Expenditure A capital expenditure ("CapEx" for short) is the payment with either cash or credit to purchase long term physical or fixed assets used in a .

#10 Cash flow statement (current year & forecast)

The cash flow statements Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period. for the current year and forecast period are constructed using figures calculated in the income statement, balance sheet, and supporting schedules. The closing cash balance for each month will be linked back to the balance sheet, shown as cash under current assets Current Assets Current assets are all assets that a company expects to convert to cash within one year. They are commonly used to measure the liquidity of a .

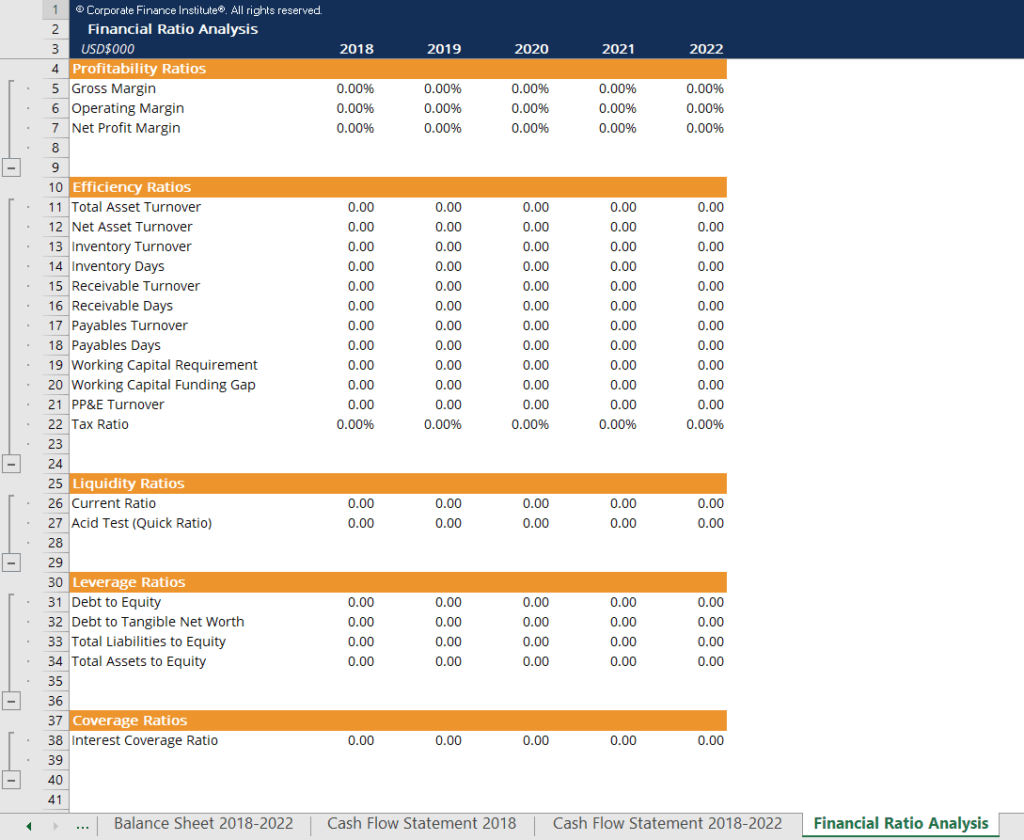

#11 Financial ratio analysis

The final section of this financial projection template is the financial ratio Financial Ratios Financial ratios are created with the use of numerical values taken from financial statements to gain meaningful information about a company analysis. This worksheet will show you the list of all commonly used financial ratios including profitability ratios Profitability Ratios Profitability ratios are financial metrics used by analysts and investors to measure and evaluate the ability of a company to generate income (profit) relative to revenue, balance sheet assets, operating costs, and shareholders' equity during a specific period of time. They show how well a company utilizes its assets to produce profit , efficiency ratios, liquidity ratios, leverage ratios Leverage Ratios A leverage ratio indicates the level of debt incurred by a business entity against several other accounts in its balance sheet, income statement, or cash flow statement. Excel template , and coverage ratios Coverage Ratio A Coverage Ratio is used to measure a company's ability to pay its financial obligations. A higher ratio indicates a greater ability to meet obligations , which are calculated using all the worksheets previously built. The ratios will allow you to understand the financial stability of the company and its expected performance in the following years.

More Free Templates

For more resources, check out our business templates library to download numerous free Excel modeling, PowerPoint presentations, and Word document templates.

- Excel Modeling Templates Excel & Financial Model Templates Download free financial model templates - CFI's spreadsheet library includes a 3 statement financial model template, DCF model, debt schedule, depreciation schedule, capital expenditures, interest, budgets, expenses, forecasting, charts, graphs, timetables, valuation, comparable company analysis, more Excel templates

- PowerPoint Presentation Templates

- Transaction Document Templates Templates Free business templates to use in your personal or professional life. Templates include Excel, Word, and PowerPoint. These can be used for transactions,

- Word Document Templates Word Templates (Transactions, Careers, HR) Download free Word templates including a Letter of Intent (LOI), Term Sheet, Non-Disclosure Agreement (NDA), Confidential Information Memorandum (CIM), Equity Capital Markets (ECM) memo, Due Diligence checklist, and other types of corporate transactions. Download the Word Document files for your own use

How To Create Financial Projections In Excel

Source: https://corporatefinanceinstitute.com/resources/templates/excel-modeling/financial-projection-template/

Posted by: knighthattlem.blogspot.com

0 Response to "How To Create Financial Projections In Excel"

Post a Comment